Gold and System Collapse: Charting the Bank Run of the Mighty US Dollar

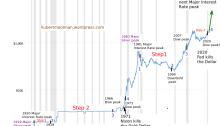

From this point debt and debt-based assets get destroyed while silver prices see some real stellar increases. This point cannot be stressed enough, since debt or credit is what this current world is built on.